Healthy financial habits can develop at a young age, but so can bad financial habits. Your children can spark a little bit of panic when they display budgetary incompetence by buying things impulsively instead of waiting for the right time and failing to understand the value of different products and services. Learn how to teach kids the value of a dollar at a young age.

Talk Openly About Finances

Some parents choose to keep children out of money conversations in an attempt to protect them from the stress of adulthood. However, the financial stressors are coming whether you talk about them or not. Talk to your children about your income, bills, taxes, savings accounts, and all other fiscal topics that peak their interest. Learning about money early on in life establishes an early educational foundation that your children can use as they transition into adulthood.

Do your best to provide a good example with your own finances. If you child points out a poor financial decision you made, talk about it. Admit where you made a mistake, what you learned, and how you plan to do things differently in the future.

Set Realistic Savings Goals With an Account For Kids

Some financial lessons are taught better in practice than through conversation or textbooks, such as patience. Setting up an investment account for kids is a great way to go. Teach your child about saving by helping them save up for a bike or a video game with the help of an investment account specifically designed for children.

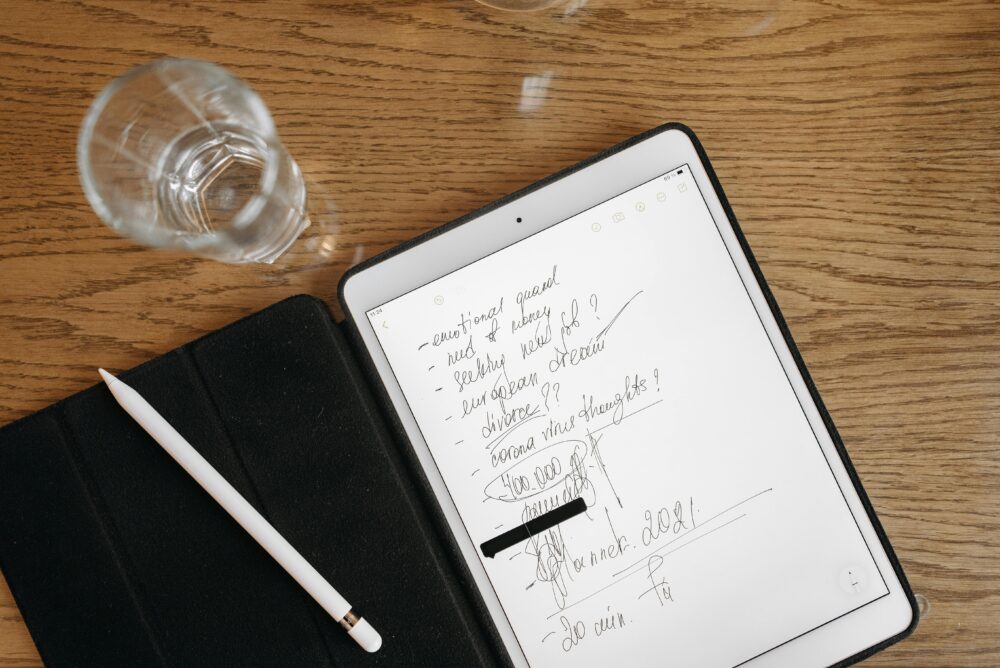

Write down the price of the goal on one side of a dry erase board and how much the child has in their investment account on the other side. Help your child determine a reasonable goal, such as %40 in a month if they can save $10 every week. While the outlook may look grim at first, your child will get more excited the closer they get to their goal.

Provide Opportunities for Your Children to Earn Money

Children have limited income options, so be understanding by offering paid work outside of typical chores, such as weeding the garden for $10.

Reward the desire to work by providing a reasonable amount of work each week. However, you may also want to encourage child business, such as a lemonade stand or sidewalk shoveling business, that allows your child to earn money that doesn’t come from your pocket.

Allow Your Children to Make Their Own Financial Decisions

Most of us made foolish financial decisions in our younger days. Let your child make their mistakes early. Restrain yourself when you want to tell your child what to do with their money. You can tell them your opinion, but you shouldn’t make decisions for them. They will probably learn the hard way once or twice. Hopefully, they learn their lesson by the time they get to college.